Who Will Be Auto-Enrolled?

Employees who meet all of the following criteria:

- Earning between €20,000 - €80,000 more annually, including income from multiple jobs

- Includes company directors without existing payroll-deducted pensions

Contribution Rates

- Starts at 1.5% from both employer and employee

- Increases gradually to 6% over 10 years

Already have a company pension?

- Review employment contracts and handbooks

- Conduct a compliance review to:

- Ensure all eligible employees are covered

- Confirm contribution levels meet or exceed AE requirements

- Clarify eligibility criteria and opt-out procedures

No Existing Pension Scheme?

Now is the time to consider setting up a Company Pension with expert guidance from Pension & Financial. Benefits include:

- Flexible contribution options

- Greater choice of investment funds

- Enhanced employee retention

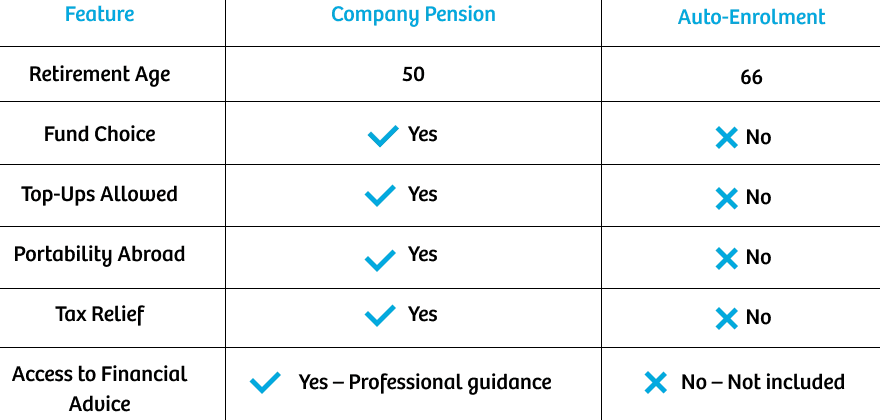

Comparison Chart AE vs Company Scheme

Note: Auto-Enrolment offers limited flexibility. It does not include tax relief or financial advice, which may disadvantage higher earners. Company pensions offer greater flexibility, tax benefits, and tailored financial support.

Support Your Employees' Financial Future

Offering a Company Pension shows your commitment to your team’s long-term wellbeing. Give your employees access to:

- Personalised financial advice

- Greater investment options

- Stronger long-term pension value

Additional Information